Written by Robert Arnone

Thanks to rapid medical advancements, it appears that we are closer than ever to a manageable situation with respect to Covid-19. Soon we will have an opportunity to reflect on the last year and, more importantly, we will adapt to life after the virus.

When will personal and business travel return to previous levels? Are you at all concerned with traveling via airline? If your answer is yes, you are not alone. During the past 9 months, we have seen a significant increase in private aircraft inquiries, as well as actual sales.

If you have ever considered aircraft ownership and are thinking that this is the right time to revisit the decision, the Canadian Government is assisting. In late 2018, the Canadian Government, as part of its Fall Economic Statement, announced the Accelerated Investment Incentive. This initiative effectively provides for an accelerated ability to deduct a portion of your capital expenditure against your taxable income. For those of us who don’t speak “tax”, this is referred to as the Capital Cost Allowance, or CCA.

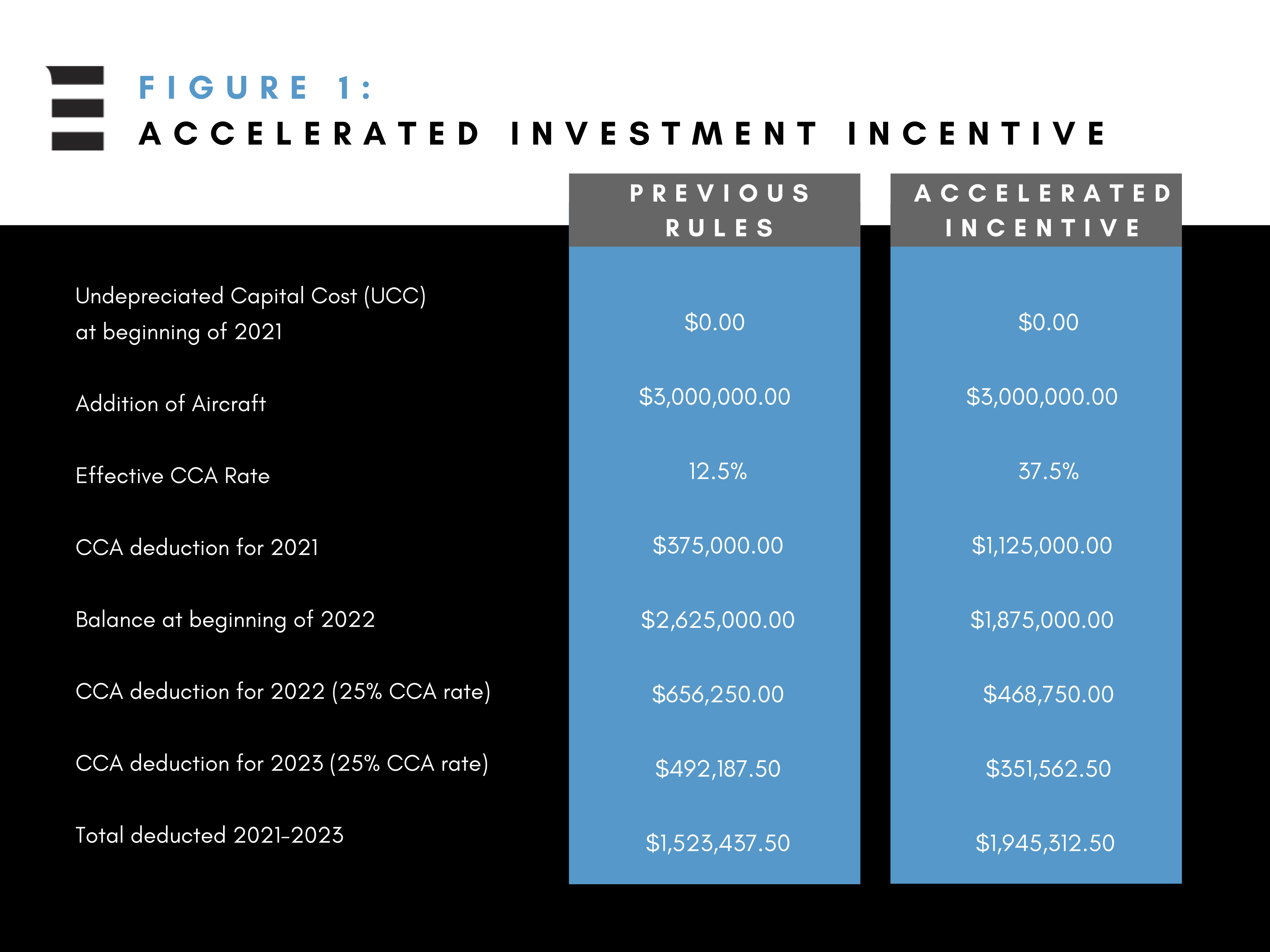

Aircraft belong to a CCA class that allows for a 25% CCA rate, however, this rate was reduced by 50% (the ‘Half Year Rule’) in the year the asset was acquired. The new Incentive both eliminates the Half-Year Rule, and increases the CCA rate to 37.5% (vs. 12.5% previously) in the first year. Subsequent years remain at 25%. Your deduction in the year the aircraft is acquired is now 300% higher than it would have been prior to the Accelerated Investment Incentive.

It is important to note that the Accelerated Investment Incentive allows for the deduction to be applied earlier and will not, over time, increase the overall amount of the deduction. This is still a good thing.

Figure 1 illustrates the effect of the deduction amounts on an assumed aircraft purchase at a cost of $3,000,000.00 Canadian Dollars.

In the example, you will note that the allowable deduction in year one is now $1,125,000.00, as opposed to $375,000.00 under the old rules.

Having said all of this, I want to be clear that I would not advise you to use tax deductions as the only reason for acquiring an aircraft, or any other asset for that matter. However, if you have been considering owning your own aircraft, the Accelerated Investment Incentive is a significant bonus. Please check with your accountant prior to purchase to ensure sure you are eligible to utilize this program. They will be able to provide you with advice that takes into account your specific situation.

If you have any questions that we can help you with, including finding you the right aircraft, don’t hesitate to reach out anytime at sales@levaero.com

Additional Resources

To learn more about Canada’s Accelerated Investment Incentive, please visit the Government of Canada website.

View Levaero’s Pre-Owned Aircraft Listings

Sign-Up to Information Lima – Levaero’s mailing list for exclusive alerts and updates on business aircraft listings.